Acronyms:

EBITDAR – Earnings before interest, taxes, depreciation, amortisation and rentals

AI – Air India

AIXL – Air India Express Ltd.

GoI – Government of India

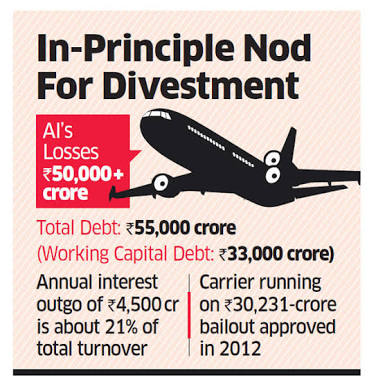

The Cabinet Committee on Economic Affairs (CCEA) approved the strategic divestment of Air India Ltd., which is burdened with a debt of over Rs. 53,000 crore, in June 2017.

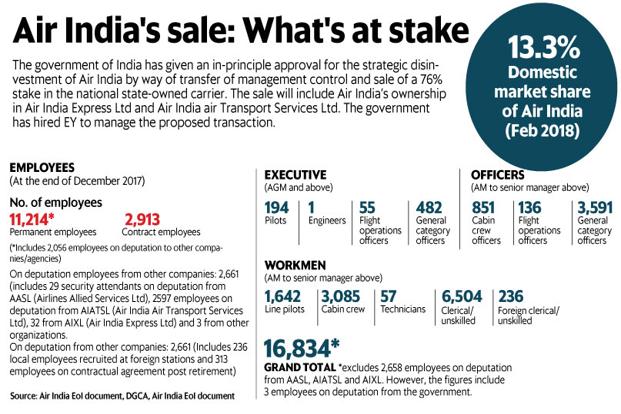

On Wednesday, the Government of India initiated the divestment process by inviting Expressions of Interest (EoI) from potential bidders.

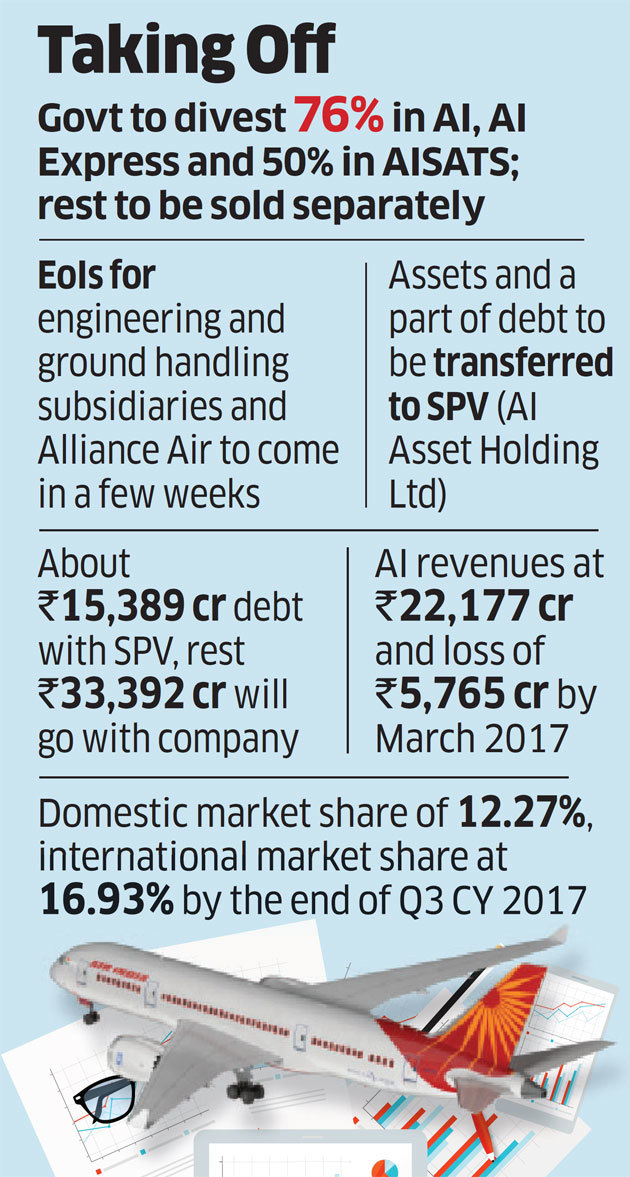

GoI owns 100% equity of Air India. It has proposed to sell 76% of its stake in Air India, along with Air India’s 100% equity stake in Air India Express and 50% equity stake in AISATS (AI’s joint venture with Singapore Airport Terminal Services) as a single entity, along with about 65% of AI’s debt, i.e. Rs 33,392 crore.

Why is GoI proposing to divest the national carrier?

AI has been unprofitable since its merger with state-owned domestic carrier, Indian Airlines Ltd. in 2007, and has always struggled with debt. Between FY2012-13 and FY2016-17, it went from an EBITDAR loss of Rs 1,208 crore to an EBITDAR profit of Rs 3,923 crore. However, owing to the increasing interest on the rising debt, net loss widened.

AI had been using taxpayers’ money to stay afloat, under the Rs 30,000 crore, ten-year bailout package approved by the erstwhile UPA government, sanctioned in April 2012.

The AI stake sale will help GoI achieve its disinvestment target of Rs. 80,000 crore for the next fiscal year, relieving it of injecting yearly bailout funds into the airline.

How will the divestment process take place?

AI has six subsidiaries with assets worth about Rs. 30,000 crore. It also has real estate worth Rs. 8,100 crore, including two hotels, whose ownership is shared by various government entities. Three of these subsidiaries are loss-making.

AI will be split into four distinct companies: core airline business, regional arm, ground handling and engineering operations. At least 51 percent stake in each of them will be offered as part of the divestment plan. GoI will sell a 50% stake in the ground handling unit separately.

Non-core and real estate assets of AI (worth about Rs. 33,000 crore), like Air India Engineering Services, ground-handling company Air India Air Transport Services, Airline Allied Services and Hotel Corporation of India, will not be a part of the sale, but will be transferred to an SPV called Air India Asset Holding Ltd (AIAHL). AIAHL will be owned 100% by GoI and take on about Rs 15,389 crore of the debt. The existing debt and liabilities of AI and AIXL ( Rs 48,781 crore) are being reallocated.

What are the terms put forward by GoI for interested bidders?

Entities interested in purchase of AI stakes should have a net worth of Rs. 5,000 crore and should have reported a positive profit after tax in at least three of the previous five financial years to send in their Expressions of Interest. Companies with negative net worth can also submit their bids, as long as they are in a consortium which satisfies the net worth requirements.

The selected bidders will be required to be invested in the airline for at least three years.

GoI has also cleared a proposal to allow foreign investors to own up to 49% stakes in AI.

India’s largest domestic carrier, IndiGo (run by InterGlobe Aviation Ltd), and Tata Sons Ltd have shown interest in acquiring a controlling stake in AI.

Future of AI

One reason for AI’s poor financial performance are delays in decisions and operations under a bureaucratic set-up. The privatisation of AI will ensure better services and swift response to changing market conditions.

Comments are closed.