There’s a good chance you’d have heard the name GameStop from your peers or come across some meme on social media on this matter. So what is the big fiasco?

GameStop is a brick and mortar video retailing store-chain in the US, with more than 5,000 stores.It’s a mall staple, but shopping centers have been struggling for years, and the coronavirus pandemic has been devastating for retailers.

So how has GameStop suddenly become the darling investment of online traders from Reddit’s wallstreetbets forum?

Before we go ahead, let’s educate ourselves with the term, SHORT. A short is when you borrow stock from a broker without actually owning it or paying for it.

To make this easy, let’s say the stock costs 10 rupees. You’re just borrowing it, so you didn’t pay 10 rupees. You then sell it immediately for the same amount, betting that you would be able to buy it back for less, later.

Let’s say in a week’s time, the stock is worth less than 10 rupees. It’s now worth 1 rupee and you decide to buy it back. Remember that you “borrowed” it in the first place. You didn’t spend 10 rupees on it but sold it for 10 rupees, and are now buying it back for 1 rupee, making 9 rupees profit. Let’s repeat: You made this profit without spending a rupee on it in the first place (other than the fees involved).

This is legal; there is no law which says people can’t buy stock and short it. Redditors have now, however, also shown that this is a proven way to stick it to Wall Street players and make a profit off of nothing.

SO, WHAT HAPPENED WITH GAMESTOP?

Good question. GameStop went through dark times in 2020, teetering on the verge of going out of business due to the COVID-19 pandemic. At some point last year, the stock price plummeted and investors began buying stock.

Then, hedge funds showed up and began “shorting” the stock, hoping to buy it back later, for much cheaper. Home traders on Reddit – specifically from the WallStreetBets saw the influx of people buying GameStop stock.

Some Redditors decided to buy stock and convinced their buddies to do the same. At this point, I should add that WallStreetBets had recently ballooned to over 3 million followers. As they motivated each other to keep piling into the shares, the stock price went up again, leaving hedge funds who took short positions liable for the current inflated stock price.

Thanks to thousands of Redditors, GameStop stock didn’t plummet as the hedge funds had hoped. To keep with our example of earlier, this is what happened: Instead of the 10 rupees stock plummeting, it skyrocketed. It wasn’t worth 1 rupee, as the hedge funds had hoped; it wasn’t even worth 10 rupees. No, it was now in the region of 500 rupees! The 500 rupees I mentioned is just an example, we’ll get to the actual prices now.

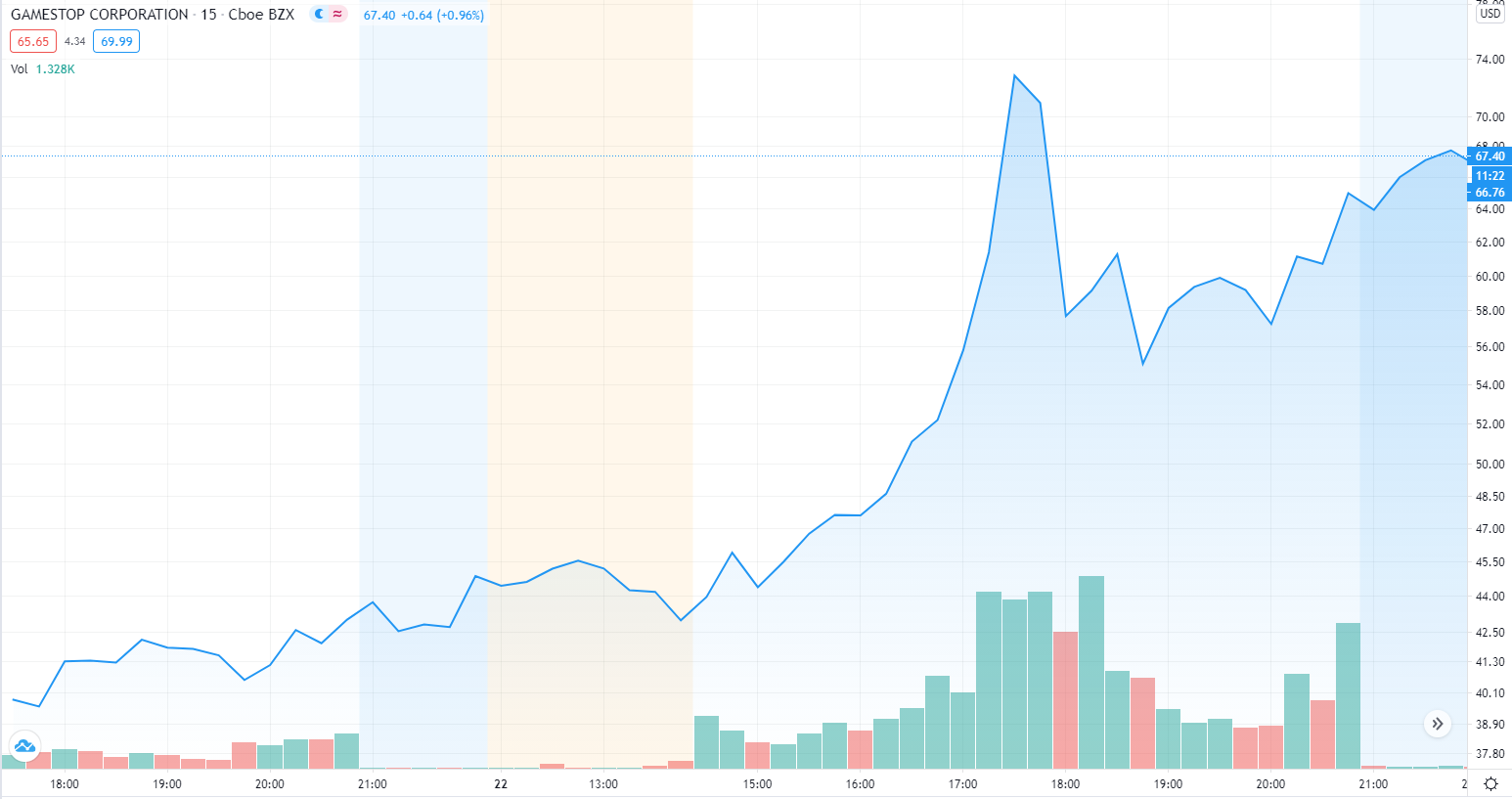

Instead of making a profit, the hedge fund losses surpassed $13 billion (yep, that’s a 13 with nine zeros). This time last year, GameStop stock was worth approximately $4.

By October 2020 it was $11 before increasing to $40 at the start of 2021. At the time of publishing – and at its highest point today – GameStop stock was worth $370 .

This led to the hedge funds having to close their short positions and buy the stock back at much higher prices. Remember they borrowed it in the first place, it was never really theirs, and as with all Lannisters, they were forced to pay their debts.