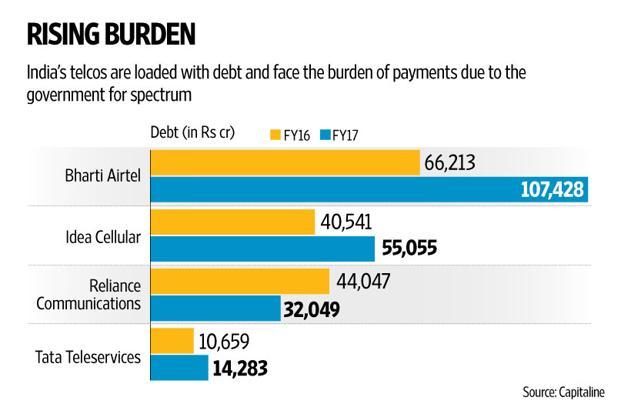

India’s telecom sector is battling brutal price competition and struggling with unsustainable levels of financial stress. Its debt stands at around Rs 4.60 trillion. However, the total sectoral liability is nearly Rs 8 trillion. This has led to the erosion of the earnings before interest, tax, depreciation and amortization (EBITDA) of the telecom service providers.

Terms Decoded:

Capex: Capital Expenditure. Funds used by an organization for upgrading equipment or infrastructure.

Amortization: It refers to the repayment of loan principal over time.

Moratorium: Prohibition of an activity temporarily.

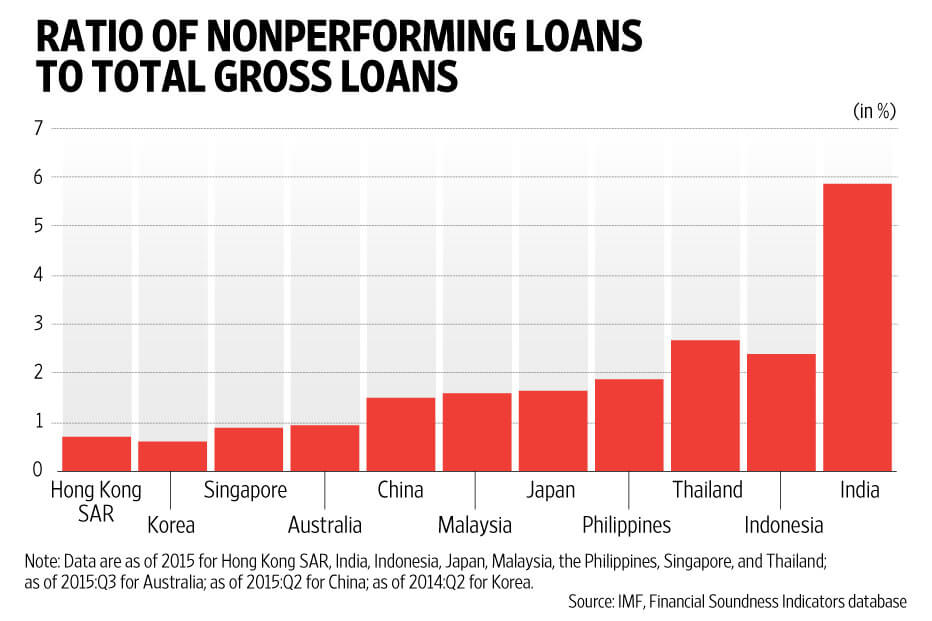

Nonperforming loan (NPL): It is the sum of borrowed money upon which the debtor has not made his scheduled payments for at least 90 days.

How did things take such a turn in a sector which was feted for providing the biggest and fastest growing market in the world after China?

The roots of the debacle lie in the misallocation of mobile permits in 2008, heavy taxes, stiff competition and the entry of Reliance Jio into the telecom fray.

Before 2008, the spectrum was given on subscriber-linked criteria. Several players entered the sector, bent on cashing in on the 3G wave, leading to significant tariff and profitability dips. The rising capex for spectrum increased financial stress, limiting the telcos’ ability to invest capital.

After 2008 started the auction of spectrum. Spectrum worth Rs 3.45 trillion has been bought, for which a Rs 1.9 trillion down payment has been made, the balance to be paid by 2028-29.

The price of spectrum in India is very high and the slow adoption of data services, coupled with the meagre average revenue per user (ARPU), has made it very difficult to recover the billions spent on it. Additionally, the sector faces high levies of about 29-32%, which is much higher than the 11-26% paid by operators in most countries.

The cumulative tax makes up a third of telecom revenues.

The entry of Jio into the sector worsened matters by offering free voice calls and cheap data to subscribers. Other companies were compelled to match these offers to retain their market position.

Economical impact and current scenario

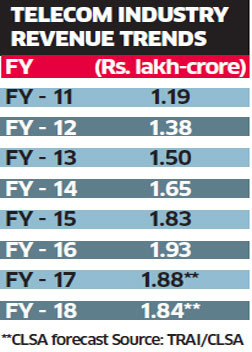

The contribution of telecom services to the GDP has declined from 2% in FY09 to 1.2% in FY17. The sector’s revenue declined by about 6% quarter-on-quarter in December—the biggest decline seen in the sector historically. A further 6% decline is estimated in FY18. The debt of telecom sector is expected to increase by 10% over the next year.

The pressure on the industry will continue post GST implementation due to increase in tax rate from 15% to 18%.

There is an imminent threat of 150,000 jobs being downsized, many of which will be due to planned mergers between companies as existing portfolios will be duplicated.

What happens now?

The industry is trying to counter problems by consolidating. Vodafone India and Idea will merge by March 2018. Bharti Airtel has acquired Telenor’s business, the RCom-Aircel merger has suffered a setback.

The Department of Telecommunications and the finance ministry have agreed on relief measures for the debt-ridden sector.

- The Telecom Regulatory Authority of India cut the interconnect user charges (IUC) to 6 paise per minute from 14 paise. The fee will be scrapped from 2020.

- The time period for the payment of spectrum has been increased to from 10 years to 18 (including a two-year moratorium), implying reduction in interest rate to 12%.

- The formulation of a National Telecom Policy (NTP) has been approved to focus on connectivity, affordable and good quality service, privacy, data protection, design development and manufacturing of telecom equipment in India.

The Cellular Operators Association of India (COAI) recommended a reduction of the spectrum usage charges and licence fee, quashing of Universal Service Obligation Fund, a five-year moratorium on deferred spectrum payment and a 12% goods and services tax rate against the proposed 18%.

At least 4 quarters are needed for the industry to improve, depending on the pending merger transactions and consumer utilization.