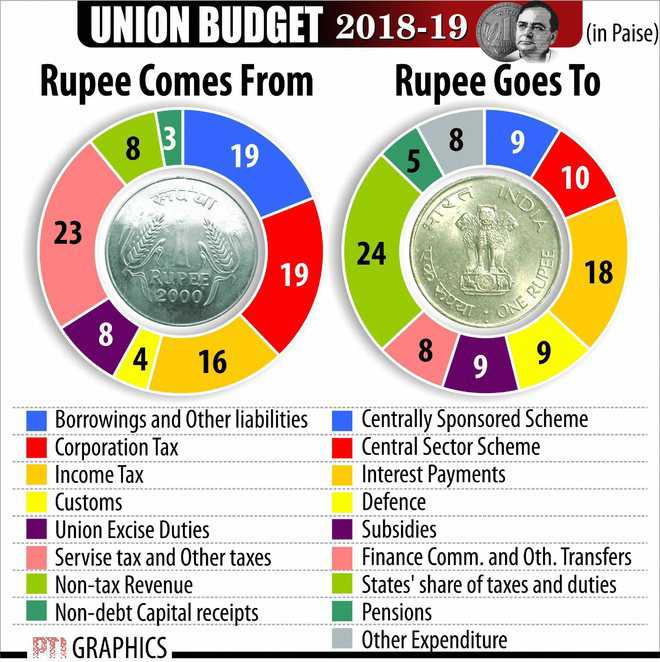

On the 1st of February, Finance Minister Arun Jaitley presented the last full budget under the Modi government before the General Elections in 2019. The bedrock of any economy – agriculture, employment, health and infrastructure – were focused upon.

How does the budget impact various sectors?

Agriculture and rural economy:

- The allocation for the food processing industry has been doubled from INR 715 cr to INR 1400 crores.

- Institutional credit for the agricultural sector and farmers’ welfare has been hiked, the former being raised to INR 11 lakh cr from INR 10 lakh crores.

- Agri-commodities have been liberalised to bridge the gap between India’s current agricultural exports and its agricultural exports potential (the difference is pegged at USD 70 billion).

- The government will procure 23 crops under the minimum support price (MSP) mechanism, by buying them at 1.5 times the input cost.

- The government will work on a large scale expansion of rural India with more than 3 lakh km of rural roads, 51 lakh rural houses, electric supply, free LPG connections and toilets being constructed and provided. This will not only boost the country’s economic growth but also generate employment opportunities.

- The government plans to double farmer income by 2022 by extending incentives in various sectors through Kisan Credit Card.

Healthcare, education and social security:

- Under the National Health Protection Scheme (NHPS), the government will provide 10 crore families with a medical coverage of INR 5 lakh per year for secondary and tertiary care hospitalisation. This scheme will give the health sector a giant boost as it would require the creation of healthcare infrastructure in various parts of the country and thus create jobs.

- The government will set up Eklavya Model Residential Schools to provide quality education to tribal children.

- The government will set up RISE (Revitalizing Infrastructure and Systems in Education) to increase research investments in educational institutions.

Infrastructure:

- The sector is estimated to require INR 50 trillion to accelerate GDP growth.

- A new initiative, NABH Nirman, will expand air capacity by five times to handle a billion trips a year.

- An INR 4,200 crore allocation for expansion of wind, solar and green energy corridor projects has been made.

- A special scheme will be set up to help governments of Punjab, Haryana, UP and Delhi to tackle pollution.

- The highest ever outlay of INR 1.48 trillion has been made on national railways with extensive track renewal, wagon procurement and provision of a safety fund.

Markets, business and finance:

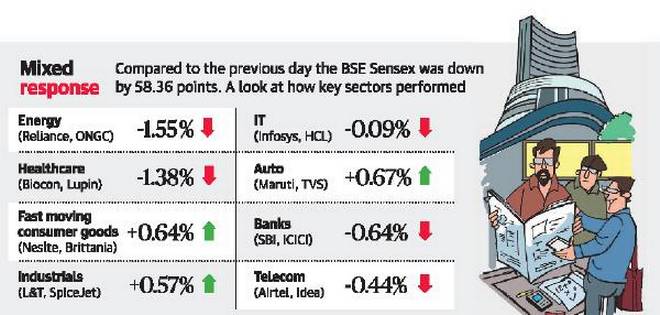

- The government has reintroduced the long-term capital gains (LTCG) tax, wherein investors will have to pay 10% tax on profits exceeding INR 1 lakh, made from the sale of shares or equity mutual funds, held for over one year. This will garner INR 11,000 crores without greatly discouraging investors and this additional revenue will help the government fund the NHPS.

- The tax department has been empowered to attach undisclosed Swiss bank accounts and offshore properties to companies’ registrars to prevent money laundering.

- An Aadhar-like legal identifier has been proposed for all enterprises.

- Cryptocurrencies have been declared invalid as legal tender in India, but the FM displayed an inclination towards blockchain and technologies like IoT and AI.

- SEBI will consider making it mandatory for large companies to raise a fourth of their finances in the bond market.

Consumers and taxpayers:

- The cess on personal and corporate tax was increased from 3% to 4% to fund social spending. Senior citizens are the biggest beneficiaries with an exemption limit of INR 50000 from bank and post office accounts, increased tax-exempt health insurance premium etc.

- The budget increased custom rates, which has made all imported products like smartphones, smartwatches, cosmetics, LED TVs, luxury cars etc. costlier. This aims to curb imports and give domestic manufacturing an impetus.

- The government will contribute 12% of wages of the new employees in Employees’ Provident Fund for all sectors.

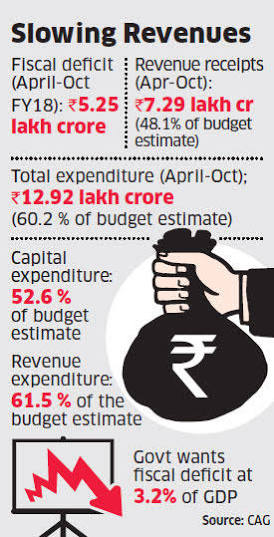

The government is targeting a fiscal deficit of 3.3% for FY18, after missing the 3.2% target for FY17. By relaxing the deficit target from 3% to 3.3% and shifting the 3% target to FY21, the FM has tried to strike a fine balance between fiscal consolidation and financial sustainability by curating a pragmatic budget.